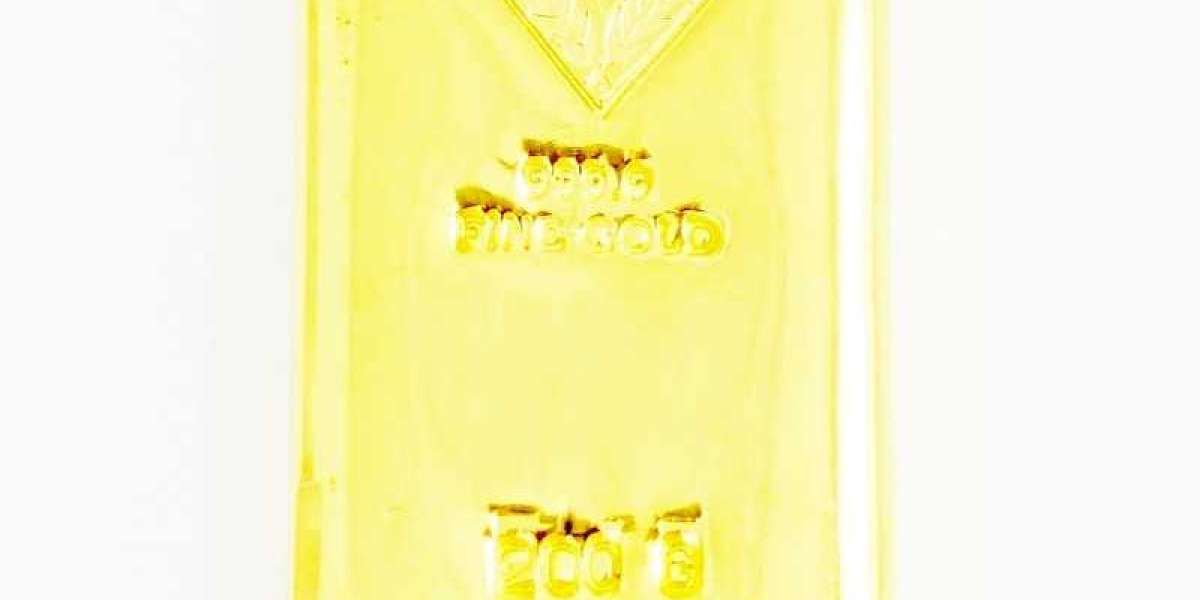

Gold has long been regarded as a symbol of wealth and a secure investment option. Among various forms of gold, bars are a preferred choice for investors due to their purity and standardization. In this article, we will delve into the 200g of gold worth factors that determine the worth of 200 grams (200g) of gold and how to make the most of this investment.

The Current Market Price of Gold

The value of a 200g gold bar primarily depends on the current market price of gold, often referred to as the "spot price." Gold prices fluctuate daily based on global economic conditions, currency strength, supply and demand, and geopolitical stability. For example, if the current spot price of gold is $60 per gram, a 200g gold bar would be worth approximately $12,000. However, premiums and other charges may apply, which we will explore below.

Purity and Certification

When evaluating the worth of a 200g gold bar, purity is a crucial factor. Most investment-grade gold bars are made of fine gold, often marked as 999.9, indicating 99.99% purity. Reputable refiners such as Heraeus, PAMP, and Valcambi produce these bars, ensuring quality and authenticity. Bars with proper certification from accredited institutions like the London Bullion Market Association (LBMA) often command a higher price due to their reliability.

Premiums and Additional Costs

In addition to the spot price, the cost of a 200g gold bar may include:

Manufacturing Premiums: These cover the cost of refining and minting the bar.

Brand Premiums: Well-known brands often charge a higher premium.

Dealer Margins: Dealers add a markup for their services.

Shipping and Insurance: If purchased online, these costs are typically included.

Comparing Gold Bars to Other Gold Investments

Investors often choose gold bars for their simplicity and cost-effectiveness. Compared to gold coins, which may carry a higher premium due to design and collectibility, gold bars offer a more straightforward way to accumulate wealth. A 200g gold bar is also easier to store and transport compared to smaller bars or large quantities of coins.

Why Invest in 200g of Gold?

A 200g gold bar strikes a balance between affordability and significant value. It is an excellent choice for:

Diversifying Investments: Gold acts as a hedge against inflation and economic instability.

Long-Term Wealth Preservation: Gold retains its value over time, making it a reliable store of wealth.

Liquidity: Gold bars are highly liquid and can be sold or traded easily worldwide.

Tips for Buying a 200g Gold Bar

Research the Market: Monitor gold prices and buy during dips to maximize your investment.

Choose Reputable Dealers: Always purchase from certified dealers or directly from refineries.

Verify Authenticity: Look for certification and assay cards that validate the bar’s purity.

Consider Storage Options: Secure storage, such as a safe or a vault, is essential to protect your investment.

Final Thoughts

The worth of a 200g gold bar is not just measured by 200g of gold worth its market price but also by its role in securing your financial future. By understanding the factors influencing its value and taking the right steps to invest wisely, you can leverage gold’s enduring appeal to grow and protect your wealth.